I wanted to tell you about Dave Ramsey’s new, free, online budgeting tool called EveryDollar. To make it relevant to learning, performance, productivity, and/or healthy living, I looked for information about money worries. Specifically, how worrying about money affects productivity and performance.

Here’s what I found in a nutshell: money worries are tied to increased stress, reduced employee engagement, and lost productivity. People spend time at work—sometimes hours a day—managing their personal finances; they lose sleep; they are ill and absent more often; and they are more likely to be preoccupied, depressed, or physically ill.

In case we’re tempted to think that this doesn’t apply to that many people, here are some numbers:

- 71% of respondents in a 2014 poll said their top source of stress was about money (Harris Interactive)

- Top source of stress for the last 6 years in a row: money (APA’s Stress in America survey)

- 70% of HR execs in a SHRM study reported that financial worries have a negative impact on workers’ productivity

How to reduce stress related to money? A UK report shows that:

The strongest predictor of financial wellbeing was how long an employee’s savings pot would last in the event of stopping working—this was even more important than individual or household income.

So let’s assume for a moment that managing income and expenses is a great way to alleviate stress over money. And that we can facilitate building savings (an antidote to money worries) as a natural extension of managing day-to-day finances in an organized way.

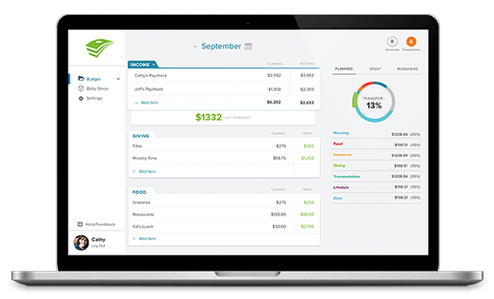

Creating a budget is an important part of managing money. EveryDollar offers some great features, for example:

- Shows a running total of how much you have left to spend

- Displays totals for planned expenses, money already spent, and dollars remaining

- Allows you to copy this month’s budget over to next month, and then adjust for variations

- Organizes your expenses into categories (with subtotals and percentages)

- Helps you create funds for future expenses (like saving for a big purchase)

- Tracks how you’re doing in the Baby Steps (if you’re following them)

- Includes an app for iPhone tracking (as I write this, they are working on an Android app)

- Adds transactions from your bank (everything else is free, but there’s a fee for this because the banks charge for it)

There are many other ways to create a budget than using Dave’s new tool, for example:

- Just use paper or download a budget form

- Use Quicken’s budget feature (clunky)

- Use other budget software, like You Need a Budget (not free)

- You can use Mint.com (free, but full of ads) or other online budget trackers

How do people get themselves into money troubles? Sometimes it’s because they have an income problem, but often it’s because they are disorganized and do not manage their money well. People who work themselves out of debt often say that creating a budget was one of the main tools that helped them to succeed.

An EveryDollar budget is easy to set up, intuitive to use, has excellent tutorials in the Help Center, has bank-level security, and was designed to be easy on the eyes (it’s kind of pretty, for a budget). During beta testing, they found that people kept using EveryDollar over time. Starting to use a budget is good, but keeping up with it is a key to financial success (including less stress, more productivity, and a healthier life).

Resources

Site | EveryDollar

Report | Financial Wellness at Work (pdf)

Post | Money Worries Impact Productivity

Site | The Seven Baby Steps

Forms | Dave’s Budgeting Forms

Post | Personal Budgeting: How to Create a Budget

Review | You Need a Budget YNAB Review—A CFP’s Opinion

Site | Mint.com

Post | How Worrying About Money Harms Your Productivity

Post | How Financial Stress Can Hurt Your Career

Post | Money Worries are Affecting Productivity

Review | Dave Ramsey’s EveryDollar Helps Create Your Budget, Meet Money Goals

Post | Why Should I Bother Creating a Budget?

Post | 11 Ways Budgeting Can Improve Your Life

Review | Bookshelf: The Total Money Makeover

Book | The Total Money Makeover